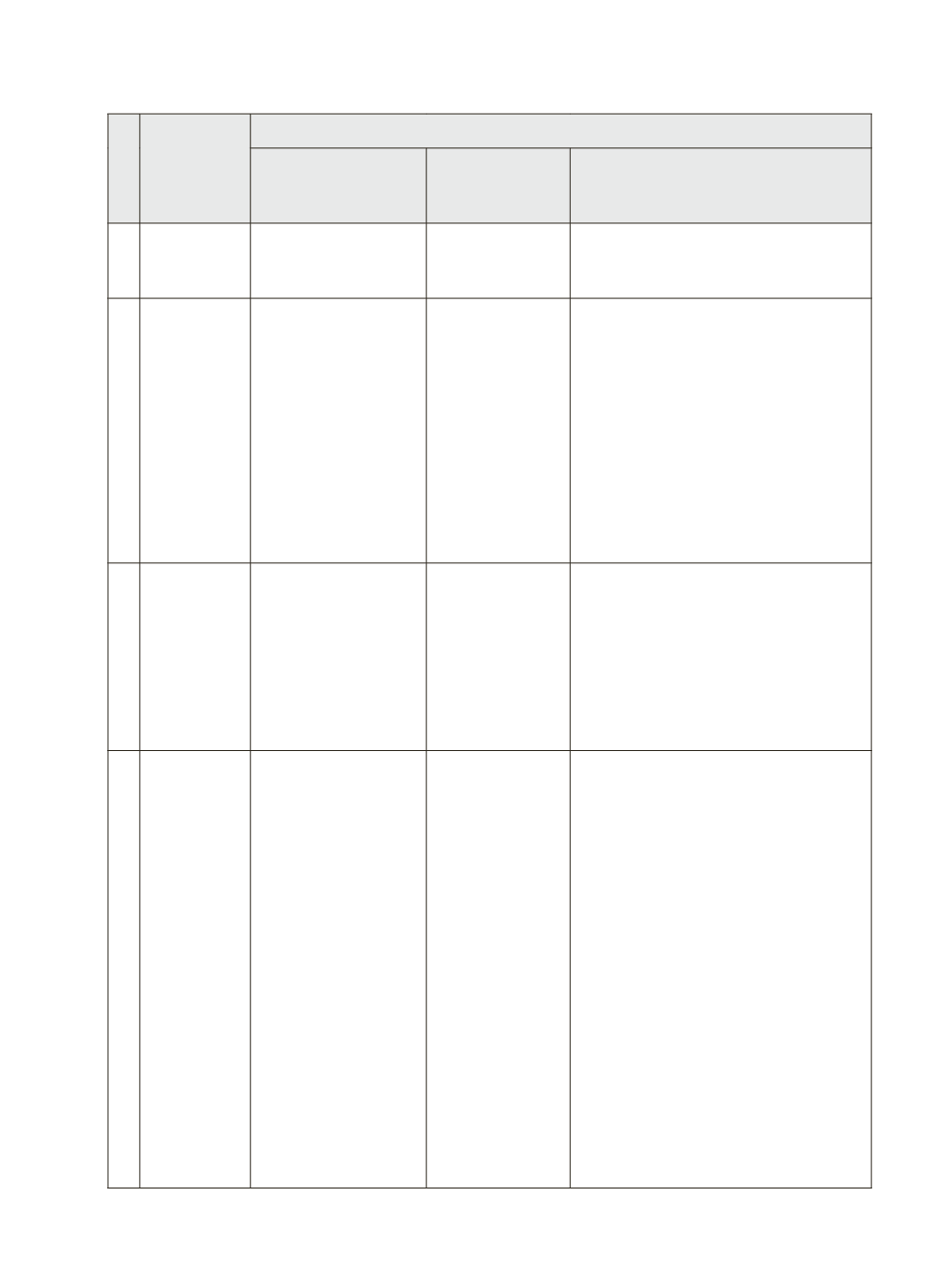

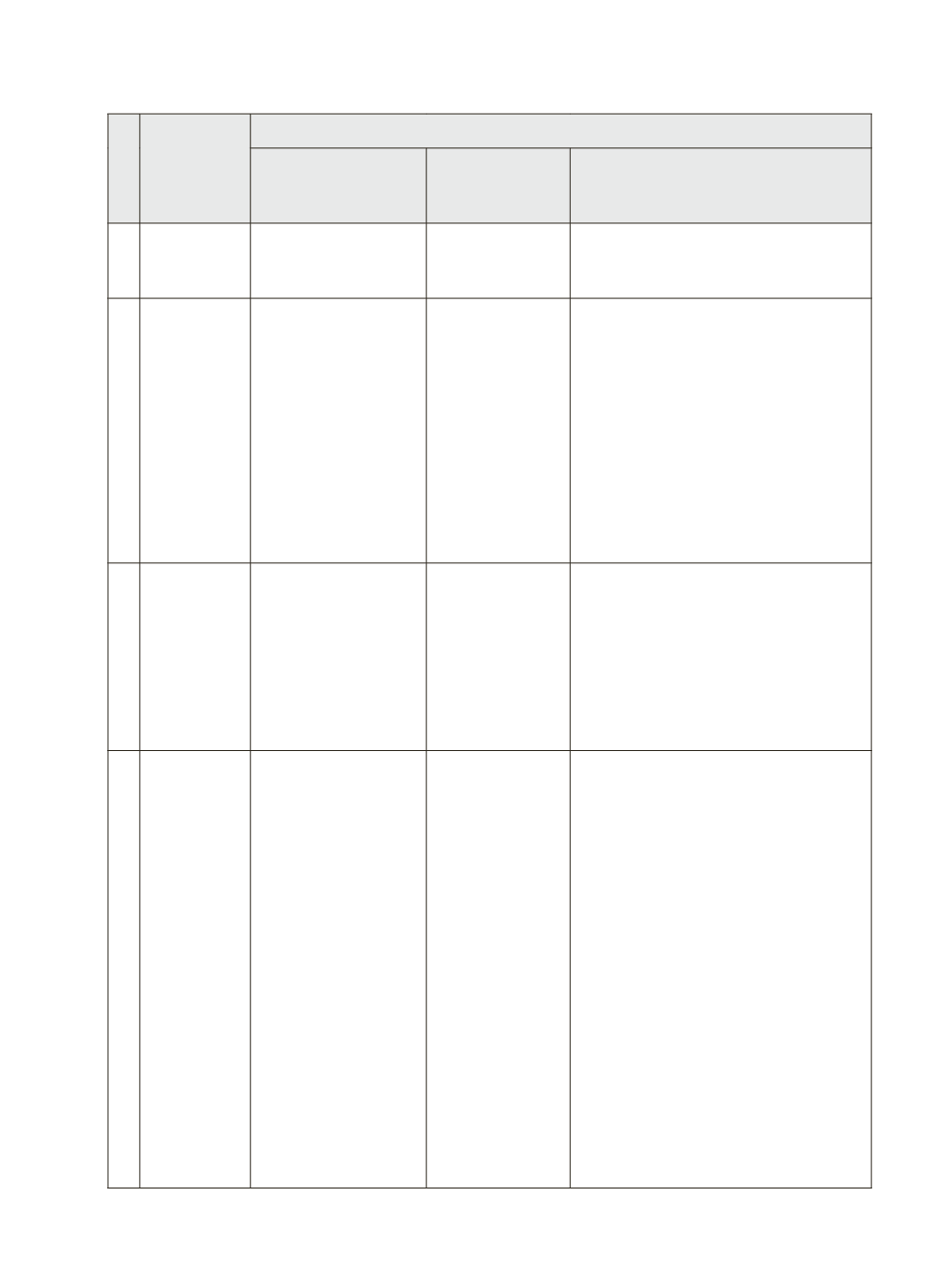

13

Table 1.2: Important features of 3 major KCC Guidelines

Particulars

Circulars on KCC implementation

Cir. No. 15/98-99

dtd. 14.08.1998

Cir. No. NB.214/

PCD.30/2004 dtd

09.08.2004

Circular No 71/PCD 04/2011-12 dtd

29.03.2012 & No. 97/PCD 10/2012

dated 20 April 2012

1 Applicability

of Scheme

Commercial Banks,

RRBs & DCCBs/

PACS

No change

No change

2 Objective/

purpose of

loan

Cultivation needs incl

purchase of inputs

Term Loan

component has

been added to

KCC

(i) Short term credit for cultivation

of crops

(ii) Post harvest expenses

(iii) Produce Marketing loan

(iv) Consumption requirements of

farmer

(v) Working capital for maintenance

of farm assets and activities allied

to agriculture

(vi) Investment credit requirement for

agriculture and allied activities

3 Eligibility S.T. Production

credit of Rs. 5000/- &

above to all farmers

Term Loan +

S.T. Production

credit of Rs.

5000/- & above

(i) All Farmers– individuals /

Joint borrowers who are owner

cultivators

(ii) Tenant Farmers, Oral Lessees &

Share Croppers

(iii) SHGs or Joint Liability Groups

of Farmers incl. tenant farmers,

share croppers etc.

4 Fixation of

Credit Limit

(i) As revolving cash

credit taking

production credit

requirement for

full one year

(ii) Any number

of drawal &

repayments

(iii) Operational land

holding (incl

leased-in land

& excl leased-

out), cropping

pattern & scale

of finance to

be taken into

account.

(i) Short Term

credit/ crop

loan keeping

in view land

holding,

cropping

pattern &

scale of

finance

(ii) working

capital credit

for activities

allied to

agriculture

in term of

revolving

cash credit

(iii) Term loan

A

. All farmers

(other than marginal

farmers:

(a)

Sort term limit for I year:

For

farmers raising crop: Scale of

finance for the crop x Extent of

area cultivated + 10% of limit

towards post-harvest / household

/ consumption requirements +

20% of limit towards repairs and

maintenance expenses of farm

assets + crop insurance, PAIS &

asset insurance.

(b)

S.T. limit for I year:

10% increase in ST limit towards

cost escalation / increase in scale

of finance for every successive

year (2nd, 3rd, 4th and 5th year)

and Term loan component for the

tenure of Kisan Credit Card,

i.e.

,

5 years