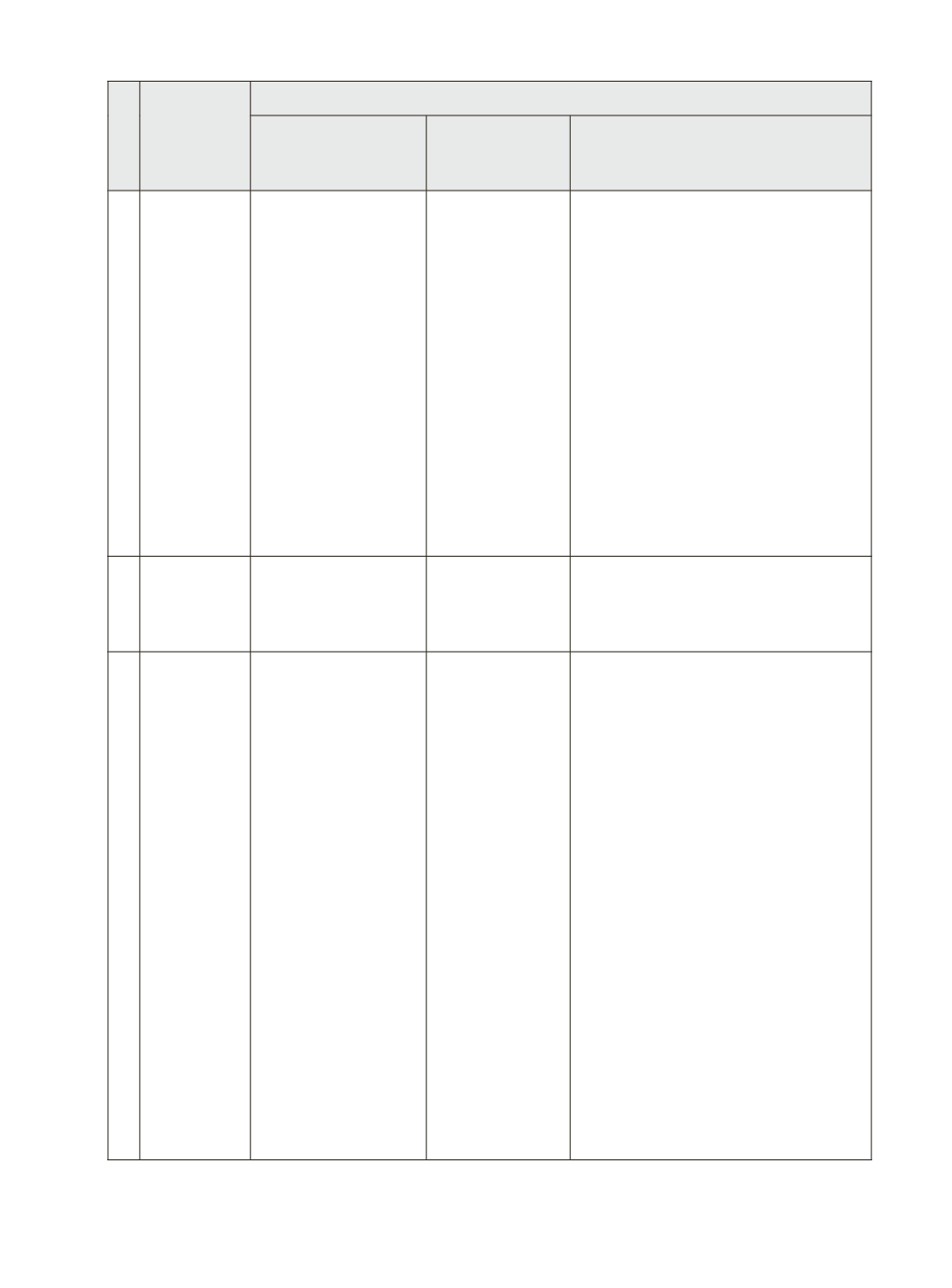

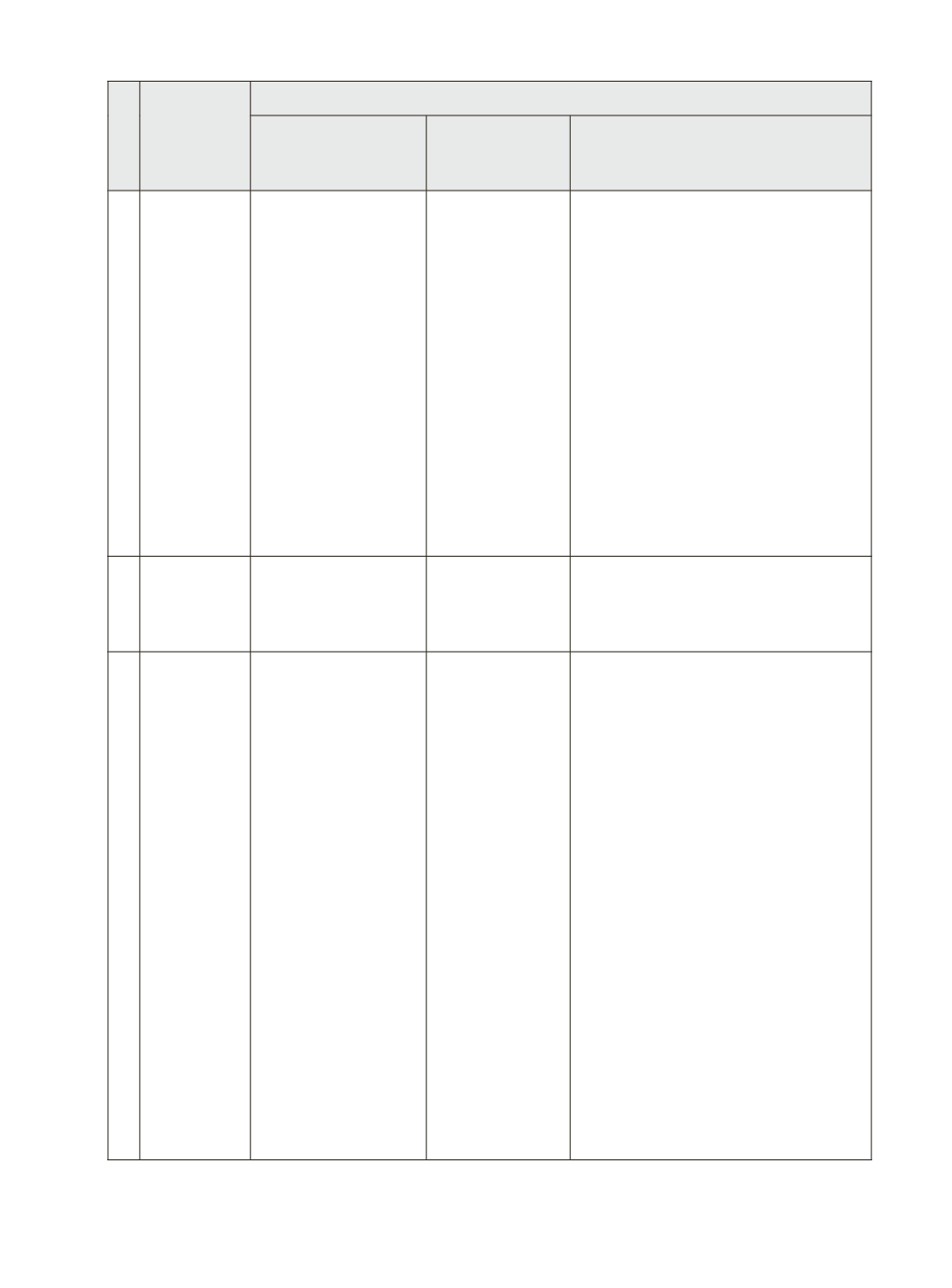

15

Particulars

Circulars on KCC implementation

Cir. No. 15/98-99

dtd. 14.08.1998

Cir. No. NB.214/

PCD.30/2004 dtd

09.08.2004

Circular No 71/PCD 04/2011-12 dtd

29.03.2012 & No. 97/PCD 10/2012

dated 20 April 2012

(iii) In case of

reschedulement

of loan,

outstanding

amount may

be transferred

to term loan

account and

repayment

period may be

refixed.

(iv) Credit limits

may be enhanced

to take care of

increase in cost

of inputs in case

of good accounts

6 Rate of

Interest

Same as applicable

to crop loan

Same as

applicable to

crop loan & term

loans

7% interest on short term credit with

an upper limit of Rs. 3.0 lakh on

principal amount

7 Repayment

Period

No drawal in A/c

should remain

outstanding for >12

months

(i) Short Term

credit/crop

loans as well

as working

capital for

agric &

allied to be

provided as

revolving

cash credit

limit,

repayable

within 12

months

(ii) Term Loan

component

will be

repayable

within

5 years,

depending

upon the

type of

activity.

(i) Short Term credit/crop loans as

well as working capital for agric

& allied activities to be provided

as revolving cash credit limit,

repayable within 12 months

(ii) Term Loan component will

be repayable within 5 years,

depending upon the type of

activity.

(iii) In case of ST loan, no withdrawal

in the account should remain

outstanding for more than 12

months.

(iv) Financing banks at their

discretion, may provide longer

repayment period (5 years) for

term loan depending on the type

of investment.